The Single Strategy To Use For Hard Money Georgia

Wiki Article

The Ultimate Guide To Hard Money Georgia

Table of ContentsLittle Known Questions About Hard Money Georgia.How Hard Money Georgia can Save You Time, Stress, and Money.Hard Money Georgia - TruthsHard Money Georgia Can Be Fun For Anyone

Because hard cash lendings are collateral based, additionally recognized as asset-based finances, they need minimal documents as well as allow capitalists to enclose a matter of days. Nonetheless, these fundings come with even more danger to the lender, and also for that reason call for higher deposits as well as have higher rate of interest than a typical finance.Along with the above break down, tough money financings and standard mortgages have other distinctions that distinguish them in the minds of financiers and also lenders alike: Difficult cash car loans are moneyed faster. Numerous standard loans may take one to 2 months to shut, yet difficult money loans can be enclosed a few days.

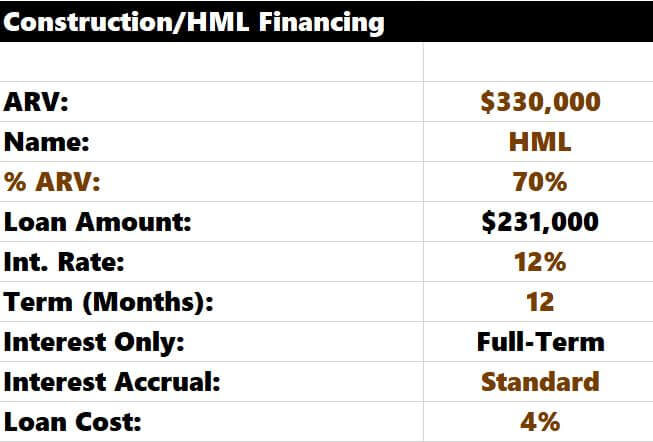

A lot of tough cash loans have short repayment periods, normally in between 1-3 years. Typical home mortgages, in comparison, have 15 or 30-year repayment terms typically. Hard money car loans have high-interest rates. Many difficult money loan interest prices are anywhere in between 9% to 15%, which is significantly greater than the rate of interest you can anticipate for a typical home mortgage.

This will include ordering an assessment. You'll obtain a term sheet that describes the car loan terms you have been accepted for. When the term sheet is signed, the loan will certainly be sent to handling. Throughout funding processing, the lending institution will certainly request records and also prepare the lending for last finance evaluation and routine the closing (hard money georgia).

Indicators on Hard Money Georgia You Need To Know

Essentially, because individuals or companies offer difficult cash fundings, they aren't based on the very same rules or constraints as banks as well as lending institution. This suggests you can get distinct, personally tailored difficult money finances for your details needs. That said, hard money fundings have some drawbacks to maintain in mind prior to seeking them out.You'll need some capital upfront to certify for a difficult money lending and also the physical building to offer as collateral. In enhancement, difficult money financings generally have higher interest prices than conventional mortgages.

Typical exit methods include: Refinancing Sale of the possession Payment from other resource There are many circumstances where it may be helpful to make use of a difficult cash lending. For beginners, investor that such as to house flip that is, buy a rundown home in need of a great deal of job, do the work personally or with contractors to make it better, after that reverse as well as sell it for a higher cost than they purchased for might find difficult money loans to be suitable financing options.

Due to the fact that of this, they do not require a Homepage lengthy term as well as can prevent paying too much interest. If you purchase financial investment properties, such as rental properties, you might additionally discover hard money loans to be excellent selections.

8 Simple Techniques For Hard Money Georgia

Sometimes, you can additionally utilize a tough money car loan to purchase vacant land. This is an excellent choice for developers that remain in the process of certifying for a building lending. Keep in mind that, also in the above circumstances, the possible drawbacks of tough money loans still apply. You need to make sure you can pay off a tough money loan before taking it out.

Tough money loans normally come with higher passion rates and also shorter settlement routines. Why choose a difficult money finance over a traditional one?

Hard Money Georgia Can Be Fun For Everyone

Additionally, because private individuals or non-institutional lenders offer hard cash loans, they are not subject to the very same laws as standard lending institutions, that make them a lot more dangerous for customers. Whether a tough cash financing is appropriate for you relies on your circumstance. Difficult money lendings are good alternatives if More Bonuses you were refuted a traditional car loan and require non-traditional funding., we're here to assist. Obtain started today!

The application process will usually involve an assessment of the property's value as well as potential. That means, if you can't manage your repayments, the hard money lender will merely continue with selling the home to recover its investment. Hard money lenders normally charge higher rates of interest than you 'd have on a traditional car loan, but they likewise fund their finances faster as well as typically require less paperwork.

Rather than having 15 to thirty years to pay back the loan, you'll usually have just one to 5 years. Hard money loans work rather in a different way than traditional car loans so it is essential to recognize their terms and what purchases they can be utilized for. Difficult cash finances are typically linked here meant for financial investment homes.

Report this wiki page